.png)

Direct Indexing Explained

Access Innovative Direct Indexing Technology All in One Place

We harness proprietary Morningstar Indexes, Equity Research, and industry-leading environmental, social, and governance (ESG) data from Morningstar Sustainalytics to create and manage highly-personalized, tax-efficient portfolios at scale.

Wide Range of Index Solutions

Powered by Morningstar Indexes, we offer a curated list of direct indexing portfolios backed by 20+ years of indexing expertise.

Wide Range of Index Solutions

Unmatched Morningstar Equity Research

We leverage Morningstar’s independent Equity Research to help build our personalized direct indexing portfolios with consistent and rigorous methodologies.

Unmatched Morningstar Equity Research

Industry-Leading ESG Data

Morningstar Sustainalytics offers ESG data and ratings covering 13,000+ companies, supporting the sustainability ratings of over 80,000 managed products globally.

Industry-Leading ESG Data

Streamlined Wealth Platform

Managing approximately $246 billion in AUM/AUA, Morningstar Investment Management provides an end-to-end direct indexing experience with a scalable suite of wealth solutions to grow your practice.

Streamlined Wealth Platform

Improve Client Outcomes With Tax-Efficient Portfolios

Our direct indexing portfolios offer personalization, tax management, and values-based options for advisors looking for greater choice and flexibility in their practice.

Gain Targeted Exposure

Deliver Personalization

Seek Tax Efficiency

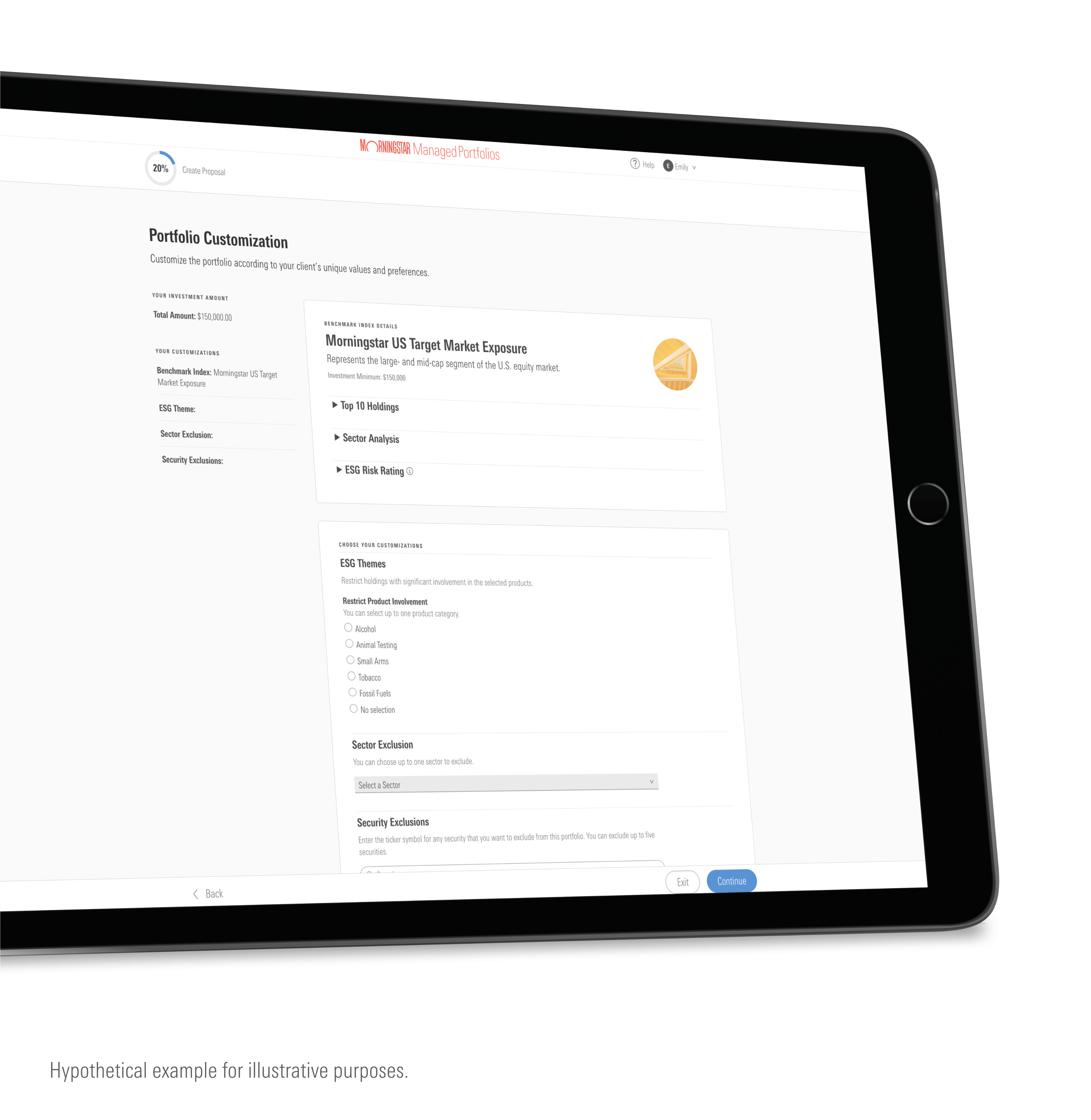

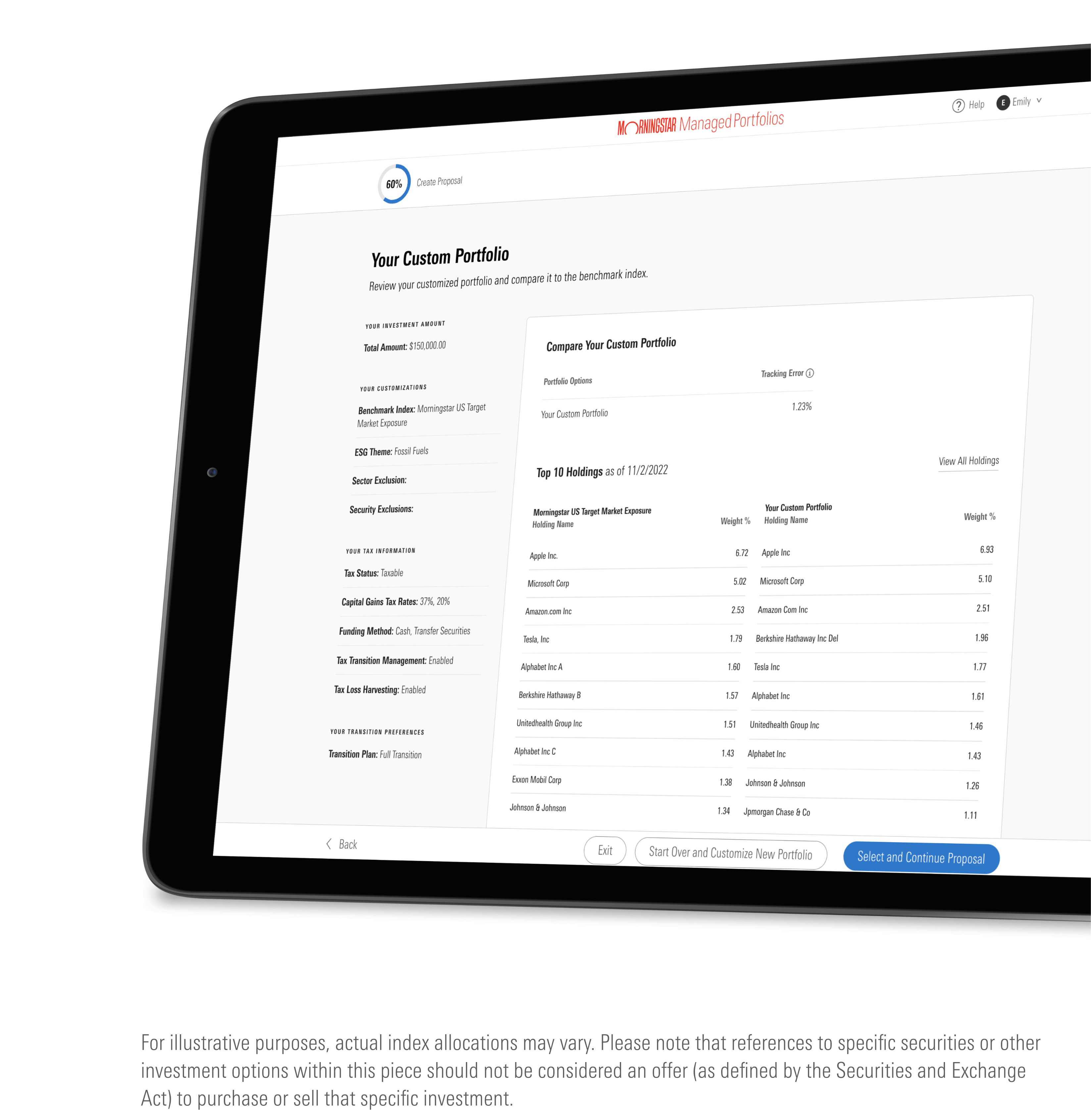

Implement Direct Indexing Strategies With Ease and Simplicity

Innovative Digital Proposal System creates increased efficiency and an intuitive, unified experience.

Streamlined Onboarding accelerates action, making it easy to invest, manage, open, and fund accounts.

Seamless Execution of electronic advisory agreements and straight through processing saves time on back-office tasks.

Personalized, Scalable Tax Management capabilities and ongoing portfolio management through our Wealth Platform.

Engage Clients with Next-Level Performance Reporting

Comprehensive Reporting System shows portfolio performance on an individualized investor level.

Detailed Reporting on the underlying holdings of the portfolio, asset allocation breakdown, and individual accounts.

Quarterly Commentary showing overall base portfolio performance, market overview and trends.

Morningstar Direct Indexing Portfolios

Grow Your Practice With Exclusive Insights

Leverage Morningstar’s data, advisor resources, and research to deliver more value to your clients and put personalization into practice.

Direct Indexing Research

On-Demand Library

Investment Insights

Talk to a consultant to learn more about our direct indexing portfolios.